EIA Weekly Natural Gas Storage Report: How to Read & Analyze

Who is the EIA?

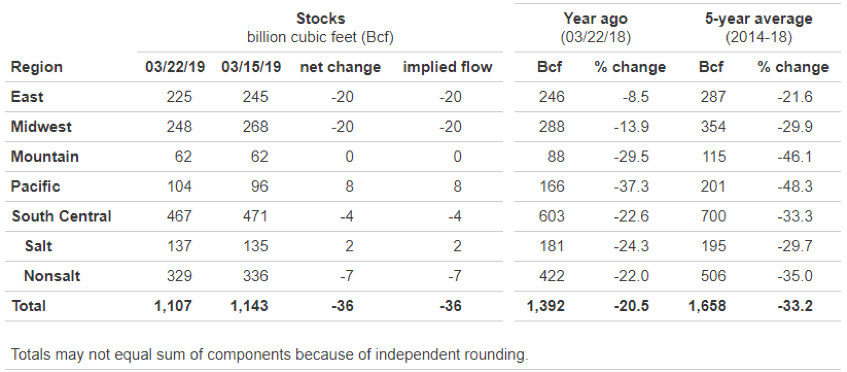

Deciphering the EIA Natural Gas Storage Report?

Where to Find the EIA Weekly Natural Gas Storage Report?

Summary

1 Investing.com. (2019, July 25). U.S. Natural Gas Storage. Retrieved from https://www.investing.com/economic-calendar/natural-gas-storage-386

2 Investopedia. (2019, June 25). Natural Gas Storage Indicator (EIA Report). Retrieved from https://www.investopedia.com/terms/n/natural-gas-storage-indicator-eia-report.asp

3 Zacks. (2017, March 13). EIA Reports Larger-than-Expected Natural Gas Draw. Retrieved from https://www.zacks.com/stock/news/252548/eia-reports-largerthanexpected-natural-gas-draw

4 Place Trade Financial. (2019). What is the EIA Natural Gas Report? Retrieved from http://www.us.placetrade.com/index.php/get-help/845-eia-natural-gas-report

5 MineralWise. (2019, July 25). Mineral Rights Value. Retrieved from https://www.mineralweb.com/owners-guide/unleased-mineral-owner/mineral-rights-value/

6 EIA. (2019, July 25). Weekly Natural Gas Storage Report. Retrieved from http://ir.eia.gov/ngs/ngs.html

7 EIA. (2019). About EIA. Mission and Overview. Retrieved from https://www.eia.gov/about/mission_overview.php

The content of this website is provided solely for general informational purposes, and not as legal or other professional advice.

The information on this website is not a substitute for, and does not replace the advice or representation of, a licensed attorney, certified public accountant or other professional. Although Rock River Minerals goes to great lengths to make sure the information on the website is accurate and up-to-date, we make no claim as to the accuracy of this information and are not responsible for any EIA Weekly Natural Gas Storage Report consequences that may result from reliance on the information contained in this website.

We recommend that you consult with a licensed attorney for assurance that the information on the website and your interpretation of it are appropriate for your particular situation. You should not rely on this website as a source of legal advice.

Join Our Mailing List

Join Our Mailing List

Thank you. Your email address has been submitted.

Rock River Minerals

Please try again later.

All Rights Reserved | Rock River Minerals, LP