Become an Informed Mineral Owner

OUR KNOWLEDGE CENTER PROVIDES RESOURCES FOR MINERAL AND ROYALTY OWNERS WHO WANT TO BETTER UNDERSTAND THEIR MINERAL INTERESTS.

Philanthropy Through Divestment Beyond personal financial goals, mineral rights and royalty divestment can help you reach your financial goals for family, friends, community and more. Why wait to leave behind your legacy, when you can use it to benefit loved ones today? Gift your children or grandchildren a debt-free education. Give your daughter with the wedding of her dreams. Ensure aging relatives will be taken care of and provided for. Your legacy is in your hands. Mineral divestment can help you start putting it to use sooner rather than later and we can help. With a straightforward and honest process, we avoid the need for middlemen, annual fees and commissions. We work with your financial and legal advisors to help you make an informed decision that suits your needs.

Two Key Benefits of Mineral Asset Divestment 1. Divest to Diversify Conventional wisdom said “hold on to your mineral assets, never sell.” Conventional wisdom also said shale was unviable for cost effective production. But insight and expertise have disproven both. Knowing when to partially or totally divest your mineral rights and royalties can help give you the financial freedom you need to diversify your portfolio and secure your nest egg. Divesting your mineral assets allows you to reinvest earnings however you choose. Safe and long-term or short term with higher upside, you and your financial advisor can choose the best strategies to meet your unique financial goals. We know because we have helped mineral and royalty owners for nearly two decades. We have closed over half a billion dollars in transactions and we have started every single one with a fair and honest evaluation. Knowing when to divest can help you diversify your portfolio and reach your financial goals. Knowing who to divest with can be just as valuable. 2. Divest to Mitigate Risk Divestment is personal. The decision to divest your minerals and royalties should be weighed with careful consideration and discussion with a financial adviser. It should be based on a number of factors including financial goals, lifestyle choices, tax implications, estate planning and major life events. It should also help limit and mitigate risk to your portfolio so your future remains secure. Historically, valuations have been based on proved, developed, and producing minerals (PDP), but today’s valuations take future drilling and completion minerals into consideration. Additionally, knowing the value of your minerals and current tax environment can help you make the best choice for your assets. You alone are accountable for your assets and your portfolio management. Mitigating your risk can help you achieve your financial goals and protect your nest egg from future market factors beyond your control.

Mineral and royalty rights are a unique and complex asset class. To understand them requires constant study and attention to the ever- changing facets of mineral value. Knowing when to hold and when to divest or partially divest your mineral and royalty rights can make all the difference to your portfolio diversification and your nest egg. At Rock River, we can help you unlock the potential of your mineral and royalty rights. As an independent mineral and royalty investment company with decades of experience, we’re committed to helping the discerning owner navigate their divestiture options. As an end-buyer of mineral and royalty assets, Rock River offers discreet, personalized service to ensure the maximum value for your assets by eliminating third-party brokers and middle-men. We provide education about your mineral and royalty assets as well as expert guidance with options tailored to fit your financial objectives. To learn more about who we are and how we can help call us at (432) 262-1478.

New Mexico’s 2 natural beauty and rich cultural traditions hold an observer’s gaze such that the State’s motto becomes self- evident: The Land of Enchantment. She is world famous for the Wild Wes 3 and her hatch chile peppers, 4 while her origin stretches back beyond recorded history into the myths and legends of her native people. “Conquered” by Spain and subsequently ruled by Mexico, her civil law heritage continues to shape the contour of the legal landscape today. As a result, the lands of New Mexico are divided between sovereign Indian nations, the United States, the State of New Mexico, and private owners. The past, then, is very much present in New Mexico. The purpose of this article is to orient the uninitiated to the complexities of New Mexico oil and gas law and to provide a helpful guide to additional resources available to the oil and gas practitioner. To this end, familiarity with the footnotes is highly recommended as they contain a wealth of hyperlinks to critical information resources. Section I and Section II of the article trace New Mexico’s development from pre-history to statehood in 1915, with particular focus on the genesis of land titles. Section III discusses the attributes of the fee mineral estate, the oil and gas lease, and provides a brief introduction to the New Mexico Oil Conservation Division. Section IV and Section V detail New Mexico’s unique community property, and descent and distribution regimes, including important historical variances. The final two sections of the article provide an overview of federal oil and gas leasing and lease maintenance with the Bureau of Land Management (Section VI), and state oil and gas leasing and lease maintenance with the State Land Office (Section VII).

A mineral lease is a legal document that defines the relationship between the mineral rights owner (lessor) and the producing or extracting party (lessee). It clearly outlines the rights and responsibilities of each party for a defined period. It is essential that every mineral rights and royalty owner fully understands each term on their oil and gas lease forms. The following seven terms are vital points in any oil and gas lease, and the way we define each term in writing can be the difference between an advantageous lessee/lessor relationship and a legal headache.

Mineral rights and royalty owners have the unique advantage of possessing financial agility and the means to build generational wealth for their family and retirement if they handle their mineral rights properly. At Rock River Minerals, we understand this unique advantage comes with numerous questions that the discerning mineral rights and royalty owner asks regularly. Answers to these questions can help owners best navigate their mineral rights and royalty ownership. The following three questions are among the most frequently asked by mineral rights and royalty owners here at Rock River Minerals, and our answers can give them a better idea of how their mineral rights can best serve their investment needs.

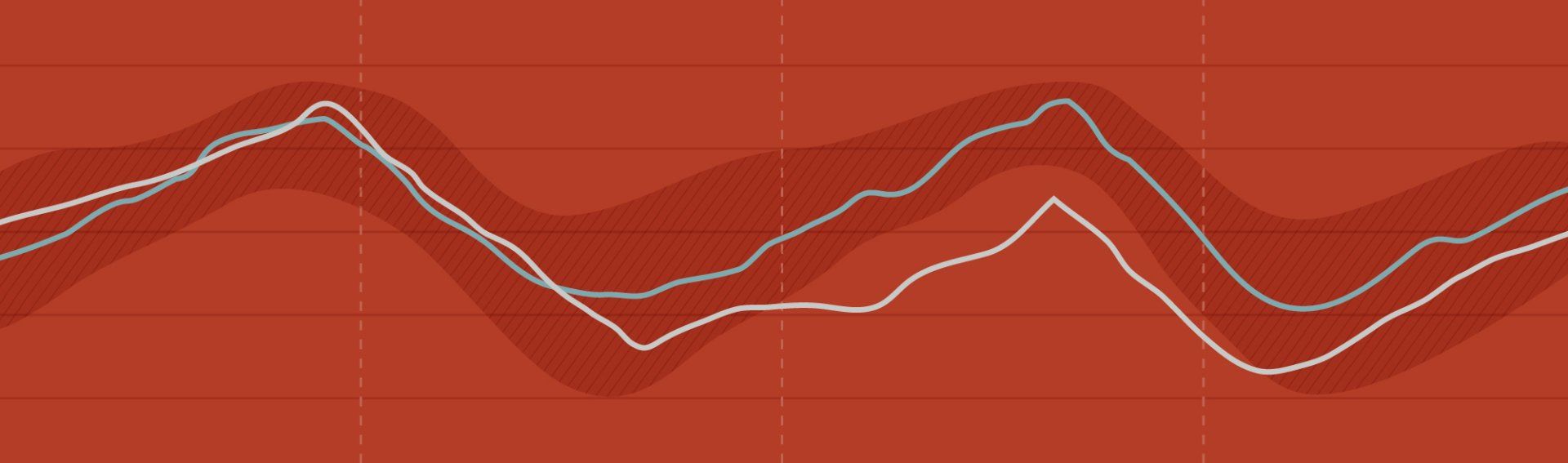

One of the most important factors in determining the value of mineral rights is the price of natural gas, which is directly affected by the Energy Information Administration (EIA) Weekly Gas Storage Report. This report contains information about the nation’s natural gas inventory levels. If a mineral rights and royalty owner is looking to buy or sell their rights, this report can provide valuable insight into the market direction and seasonal trends. For example, natural gas prices and demand are known to rise during the winter months, as it is necessary for heating. This type of information helps mineral rights and royalty owners understand present and predict future cash flow based on historical demand and current inventory situations.

The Permian Basin in West Texas and New Mexico has rapidly become the largest source of new oil reserves in the United States. Drilling activity in the region is dominated by hydraulic fracturing, or frac’ing, which enables operators to access previously unreachable hydrocarbon resources located in tight shale rock formations. The tremendous upsurge in oil and gas drilling in the Permian has created challenges for operators in the region due to the difficulties they can face acquiring sufficient supplies of water for drilling and in managing the “produced water” generated by the drilling process. Frac’ing involves injecting large amounts of water, along with proppants such as sand and some chemical additives, into shale rock formations, opening up fractures to release the trapped oil and gas found there. A single frac’d well, on average, can use from 500,000 to 700,000 barrels of water – equal to more than 21 million gallons. As production continues to expand in the Basin, operators tend to use larger drilling pads to serve multiple wells, as well as extend lateral lengths to improve well yields. These tactics increase the demand for supplying, transferring, storing, and maintaining water at the location of each pad.

By the end of 2018, American production of oil and gas surpassed both Russia and Saudi Arabia, making the United States the world’s largest oil producer. 1 The origin of the present-day oil boom is the consequence of new technologies, which have enabled economical extraction of oil deposits from rocks once considered not viable for production in places like the Permian Basin in Texas and the Williston Basin in North Dakota. As a result, a fascination with shale as a new source of hydrocarbons (oil and natural gas) has risen to the surface of our national consciousness. Words like play, shale, and basin appear in the news media, pop up on crossword puzzles and dominate conversations at the water cooler – especially among mineral rights and royalty owners. Although these terms may sound a bit complicated, we are here to give a quick primer on all you need to know to take a seat at the table with other experts in the field. Geological basins are the birthplace of oil and gas reserves. These large, low-lying areas are formed by the movement of plate tectonics (the earth’s crust) with a variety of environmental settings. Basins are landscapes of the past, which have been filled in with rocks and sediments accumulated over millions of years. Picture a layer cake, where the oldest rocks lie at the bottom and the youngest at the top.

Hydraulic fracturing, commonly called frac’ing, is a completion technique in oil and gas operations that uses a high-pressure mixture of water, sand and chemical additives to unlock hydrocarbon resources such as oil and gas. The frac’ing process is mainly used in shale formations, where tight underground rock structures make traditional methods of producing oil and gas uneconomic. Frac’ing can be defined as a well stimulation process designed to maximize underground resource extraction. The process typically includes drilling a particular formation, casing the formation, completion or stimulating the well using water from the surface, producing the well, and disposing of waste from its operation. It is commonly used in conjunction with horizontal drilling to reach energy deposits that could not be accessed via traditional vertical drilling methods.